Is i viewing a decrease from the old-fashioned reverse financial? It just after-well-known old age lifeline could have been falling out away from like recently, particularly in the latest aftermath of market meltdown and you will plummeting homes pricing.

Scotty Basketball, a real house attorneys and you may mate having Stewart, Melvin & Frost, focuses primarily on residential and you can industrial a residential property rules while offering advice toward pattern.

If the debtor passes away or ilies have to decide so you can often pay back the money or turn-over the newest keys to the lender no other obligations

Scotty: Contrary mortgage loans allow a homeowner who’s 62 or older to borrow money contrary to the worth of their home.

An other mortgage is even known as a great non-recourse mortgage given that retired people can be inhabit their houses so long as it like to without any load of typical financing money.

Question: There have been an effective bit of negative development in the opposite mortgage loans nowadays. Could it possibly be something that older people is always to end?

Scotty: Not necessarily. Contrary mortgages are generally viewed as that loan regarding last resort when you are reversing brand new collateral that you’ve saved up of your house. Then it necessary for an excellent retiree whoever fixed income was not adequate to make ends meet or even look after an excellent practical well being.

Contrary mortgages is going to be a good monetary approach in the event cash advance Glastonbury Center Connecticut that done right, particularly if you require the currency and do not have to flow from your own home. You just have to just remember that , consumers are still responsible for their property taxes, restoration and you can insurance coverage. It’s not a no cost journey.

It’s certainly correct that opposite mortgage loans had been a little controversial. But that is due primarily to some accounts away from cons targeting desperate homeowners having deceptive advertising. And additionally, in the homes drama in recent years, certainly one of most of the 10 the elderly that have a contrary home loan lost their where you can find standard or foreclosure just after their home philosophy plummeted.

Most of the crappy visibility to own opposite mortgages is likely one need that you’ve seen a number of the reverse-mortgage brokers move to top star recommendations inside their Tv advertising.

Scotty: The pace of opposite-home loan credit keeps naturally slowed. Just how many contrary-real estate loan originations backed by the us government peaked around 115,000 in 2007 and you will was down to merely 51,000 money when you look at the 2012 along side United states.

I’d feature this new downwards development backwards mortgages to a lot of other variables, just the new crappy visibility. The dramatic lose in home possessions values nowadays has just disappointed a good amount of reverse mortgages just like the there’s not just like the far equity to own consumers to attract off their property.

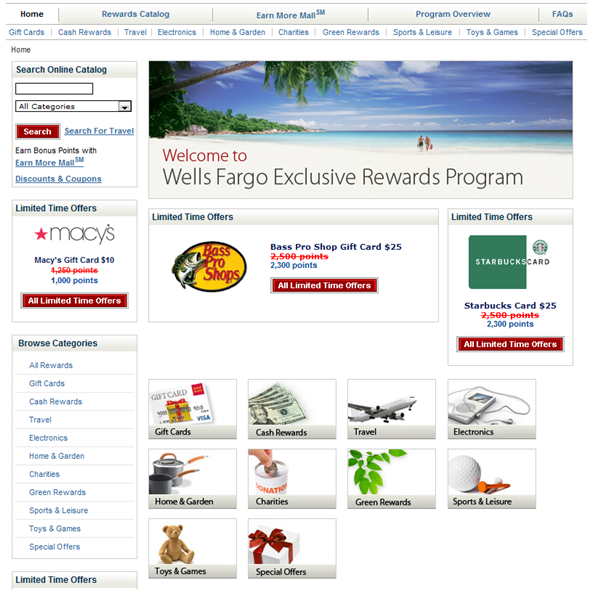

Fewer big banking companies are offering reverse mortgages due to particularly activities given that discount, troubles into the assessing accredited consumers, and you may public relations concerns within the prospective foreclosure for the the elderly. MetLife, Lender out-of The united states and Wells Fargo are all former reverse-lenders who possess exited the market.

Enhanced control of the reverse-home loan community has been yet another component that made it a lot more problematic for individuals so you can qualify. Question: What information are you experiencing for all those thinking about an other financial?

Scotty: I really don’t have to sound are a competition of reverse mortgages. There is a place for this financial automobile, especially for older people who’ve not any other way to support by themselves. However you must be cautious, because you you certainly will chance are bad out-of. Thought talking to an experienced houses specialist, nearby banker, financial coach, otherwise court mentor.

By taking out an other home loan, combat the latest enticement from providing all the currency call at a good lump sum payment. Grab merely what you would like, and make sure you still have sufficient money left over to pay your house insurance policies and you may fees. And, you should fighting the new temptation of taking right out a contrary mortgage too quickly into your senior years. It would be better to delay that choice as long as you should. And essentially, it ought to be a complement, maybe not an initial supply, regarding old age earnings.

Its different from a house-equity loan, as the contrary-financial borrower is not required generate monthly payments towards the debt

Finally, I want to claim that Really don’t think we are going to come across opposite mortgage loans subside any time in the future inspite of the latest wide variety demonstrating a decrease nowadays. This is because we possess the ageing child boomer populace today typing its retirement age, to expect you’ll get a hold of a rise in consult, even with higher control and better being qualified requirements having reverse mortgage agreements.