The lenders is not simply your HOA fees and also credit cards, car and truck loans, and the home loan on the monthly construction expenditures, and therefore it apply to your own DTI ratio.

A higher DTI proportion mode you happen to be recognized as a larger exposure just like the a lot more of your earnings is verbal to possess. So, in case your HOA charges was highest, your own DTI proportion increases, which will make it more complicated so you’re able to qualify for a mortgage.

Consider it given that a balance measure – on one side, you really have your revenue, as well as on another, the money you owe. The secret would be to hold the measure well-balanced, otherwise in addition to this, angled in favor of earnings.

Analogy Circumstances

- Scenario 1: Believe you may be to invest in a flat that have an enthusiastic HOA fee off $3 hundred a month. Their monthly earnings was $5,000, while have $step one,000 in other expense (such vehicles costs and you will student loans).When you add the $300 HOA fee, the complete month-to-month debt obligations diving to help you $step 1,three hundred. It means your DTI proportion grew to become twenty six%.When your lender’s limitation appropriate DTI proportion are twenty-five%, that it apparently short HOA payment is the extremely thing one stands between both you and your mortgage approval.Its a while such as are ready to panel an airline just are eliminated because your handbag is but one pound more the extra weight restriction. Difficult, proper?

- Circumstance 2: Image this: you happen to be ripped ranging from a couple of homes which you positively love. You have an effective $150 monthly HOA payment, and also the other features nothing. Without any payment, you could potentially qualify for an effective $3 hundred,000 mortgage.However, towards fee, the lender might only approve your for $270,000. It is a subdued difference but an important one to. That $29,000 you are going to indicate the difference between delivering property with all of the characteristics you prefer or needing to lose.

Conclusions

Navigating the world of homeownership can be a bit problematic, especially when you are considering finding out if the HOA fees are element of your mortgage. However one to there is cleared the new fog doing it, it needs to be super easy.

I dove on the nitty-gritty of whether HOA costs are part of their mortgage payments, the way they apply to your general homes can cost you, and you can all you have to bear in mind whenever cost management to have a property contained in this an HOA community.

TL;DR? Was HOA charge within the mortgage? No, they aren’t; HOA charges are often separate from your own home loan.

But whenever you are HOA charges is almost certainly not part of your own mortgage, they truly are still a switch little bit of brand new mystery in terms into the overall housing costs. Disregarding them you may put a great wrench on your own economic plans, so it is vital to factor all of them into the regarding the rating-wade.

Secret Takeaways

- Usually are HOA costs on your own month-to-month finances to get rid of unexpected situations.

- Check with your bank to know exactly how HOA fees you are going to perception the loan approval.

- Take control of your funds intelligently to ensure HOA charges do not threaten their mortgage.

Need assistance figuring out HOA fees plus mortgage? Get active support from our specialist HOA attorneys to ensure you will be making the best monetary decisions for the coming. Getting an associate now, and you will let’s get you on track!

The word might sound a bit complicated, thus let’s clarify what a keen HOA financial try. The financial is the financing you take over to get your family. Consider it due to the fact vehicles you have chosen because of it journey (your house-to acquire processes).

Alternatively, and work out existence even smoother, automated payments shall be set-up, making certain you do not skip a due date. Of many HOAs bring electronic money, where charges is subtracted out of your family savings without your having to elevator a thumb.

The fresh Part off Escrow Account

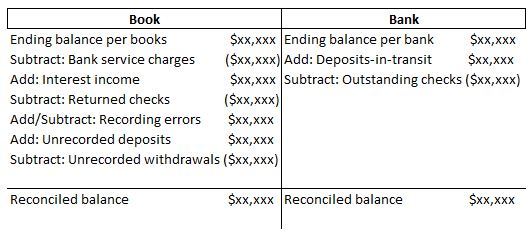

To work that it aside, it estimate some thing called the obligations-to-earnings (DTI) ratio. It proportion is actually a way of measuring how much of the income visits repaying expense.